Analysis

1/11/21

3 min min read

Deep Dive: Reasons for the NFL's Scoring Explosion in 2020

By Peter Engler and Robert Simpson

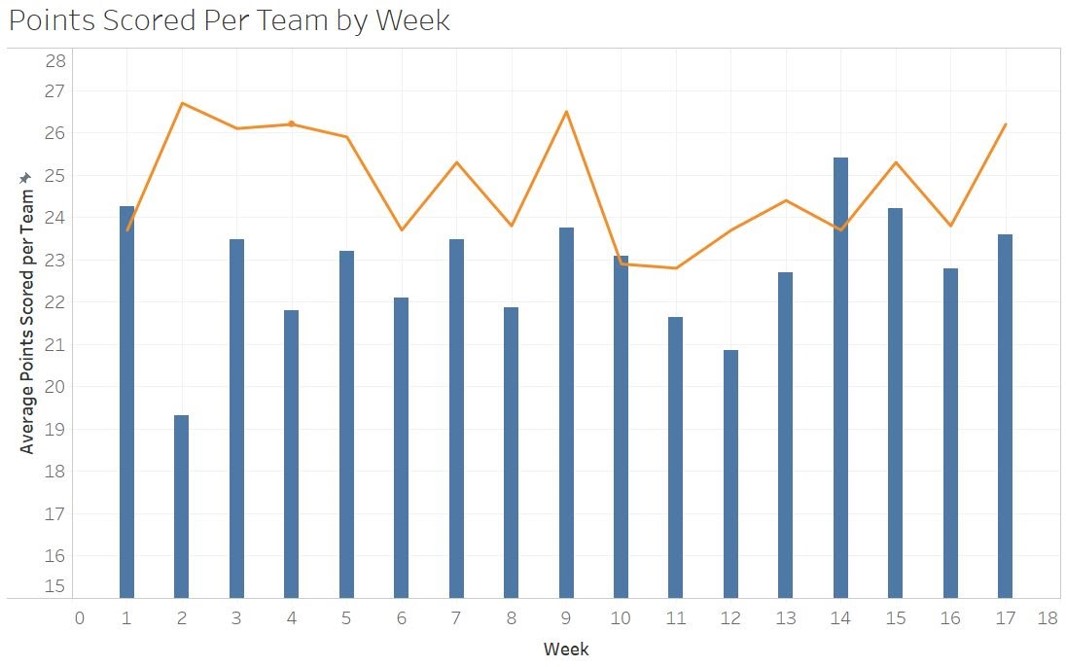

The 2020 NFL season saw a record-setting offensive explosion. The 12,692 points scored was the highest total in NFL history by a significant amount. The 24.8 points per game also set the all-time record and represented an 8.8% increase over last season -- the largest season-to-season increase since 1979, when the league began relaxing offensive restrictions to deliberately open up the offense.

However, the 2020 offensive explosion could have been larger, as the scoring from the first four weeks of the season was a 16% increase over those weeks in 2019.

Furthermore, the league saw its least amount of parity in at least a decade, as 13 teams won 10 or more games and nine teams only managed 5 wins or less.

As seen in the above chart, only three weeks (1, 10, 14) of 2019 saw more points scored than their 2020 counterparts, and Weeks 2-5 and 17 saw a particularly large jump.

It’s likely that the early-season spike is directly related to the lack of offseason activities, as defenses struggled to get in sync. The Week 17 spike could stem from the new playoff format. With the playoff roster expanded from 12 to 14 teams, more teams were fighting until the very end of the season for playoff positioning and therefore trying harder to score.

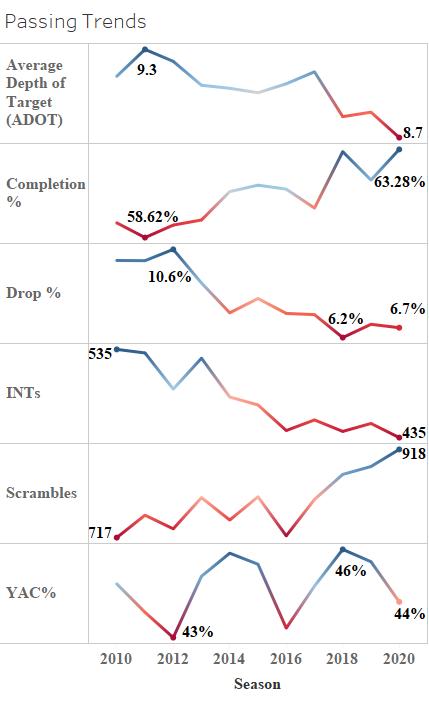

When evaluating statistical trends over the past decade, several stats jump out as particularly illuminating. In particular, teams have been attempting shorter and shorter throws, leading to a higher completion percentage but also fewer drops and interceptions. Two other notable trends from the passing game pop up, particularly the significant increase in QB scrambles and the lack of a significant increase in yards after the catch despite the shorter throws.

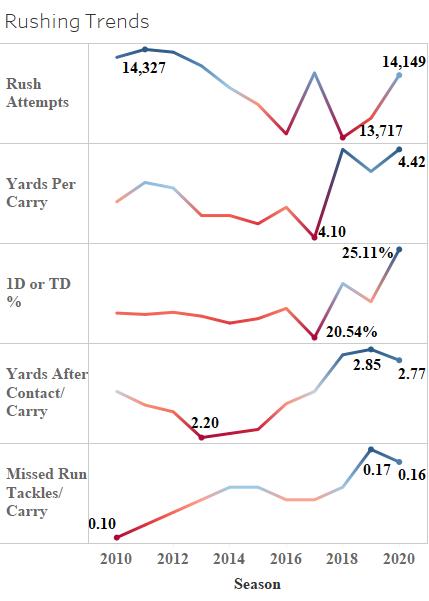

In the run game, the first half of the 2010s saw a steady decrease in attempts (with a large outlier in 2017), but 2020 saw an enormous return to form for rush-led attacks without sacrificing the significantly-improved efficiency metrics of the past few years. Despite over 14,000 carries in 2020, the NFL tied its most yards per carry of the decade, while a ludicrous 25% of carries went for a first down or touchdown. While rushers have managed to break more tackles and pick up more yards after contact in the past couple of years, this isn’t something we saw spike in 2020, indicating that fears of drastically-worse tackling isn’t supported by this information.

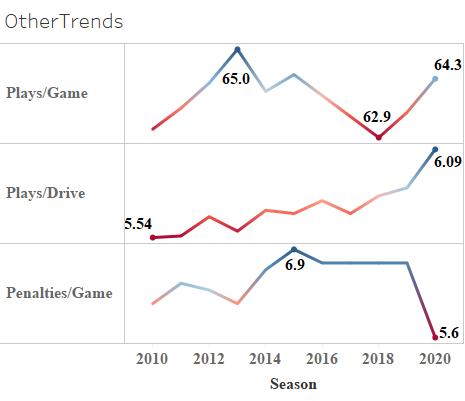

Our final three significant trends are potentially most instructive in looking at why scoring spiked so significantly in 2020. While plays per game did continue its two-season spike, plays per drive saw an enormous leap, and penalties per game fell off a cliff. The likely conclusion isn’t that teams simply had more opportunities to score, but rather that they were more efficient in doing so.

Most of our data points to the idea that scoring in 2020 increased so significantly because teams were able to consistently move the chains and keep drives alive. With far fewer penalties, specifically offensive holding, as well as the proliferation of scrambling quarterbacks, teams were able to stay in manageable down-and-distances without being forced into obvious pass situations. This allowed teams to throw high-percentage completions and run the ball with frequency and efficiency otherwise unseen this decade.

While there are a lot of competing theories about how specifically the lack of an offseason factors into this equation, a compelling idea is to consider defenses as weak-link systems, highly dependent on even their weakest member. A mistake from a safety can result in a touchdown, while a mistake from a receiver usually results in a different receiver getting the ball. This translates into lots of different factors, including run fits and rush lanes, and hints that the cohesiveness of defensive units could be affected a lot more by the lack of an offseason program than an offensive unit. It will be particularly telling to see how these trends respond in 2021 after (hopefully) a full offseason.