NFL Analysis

6/18/24

10 min read

With The Increase Of The NFL Salary Cap: What Trends Could We See?

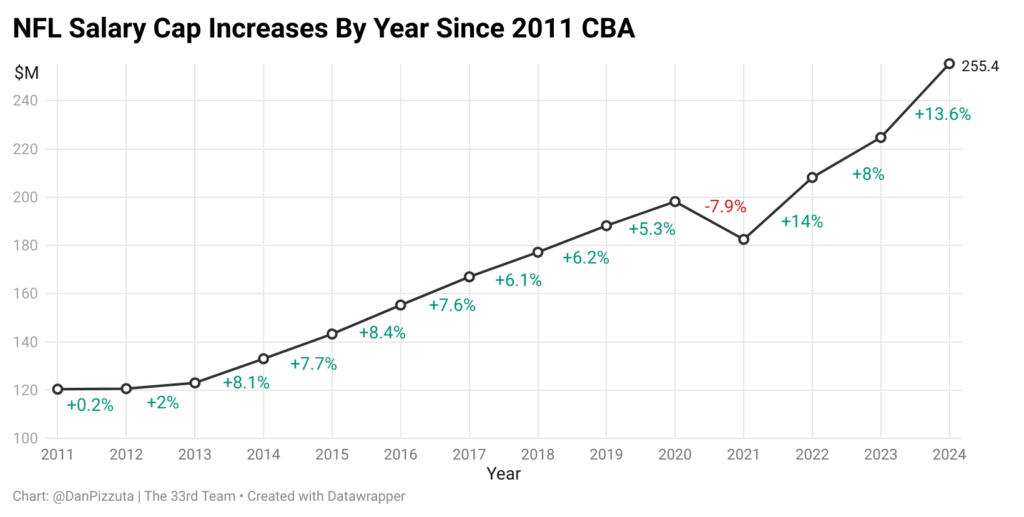

There is more money in the NFL than ever. Outside of a dip from the pandemic, the salary cap has grown steadily each season.

From 2014-2020, there was a steady increase between five and eight percent. Then, the cap dropped following the 2020 season. The rebound resulted in a 14 percent increase. After returning to a more typical eight percent from 2022-2023, the cap exploded to a 13.6 percent increase.

It was the biggest non-pandemic-related bump, and with revenue streams continuing to increase, there are no signs of slowing down.

With those increases, we’ve seen several big contracts given out during the past few seasons. Just in the past two weeks, we’ve seen Justin Jefferson become the highest-paid non-quarterback and Trevor Lawrence tied for the top average annual value for quarterbacks.

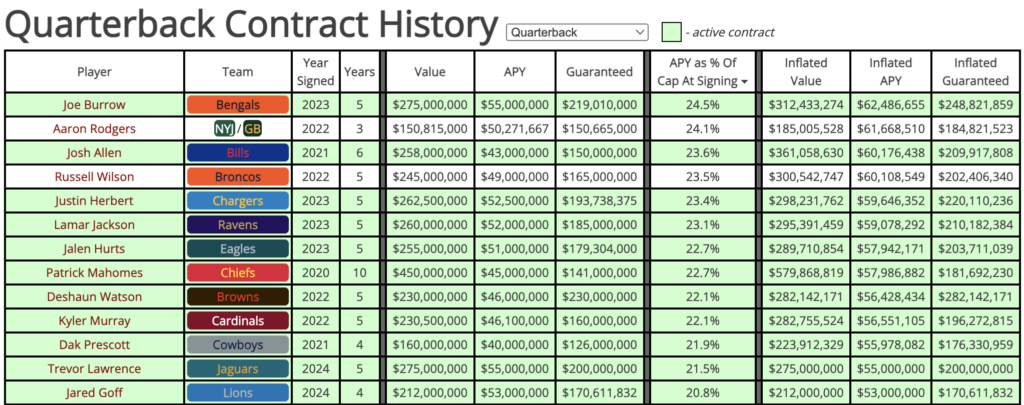

The continued cap increase should factor into how we view some of these contracts. While the raw numbers are big, the percentage of the cap these contracts take up isn’t new.

For example, Jefferson’s contract averages $35 million annually, which is 13.7 percent of the current cap figure. While that’s high, it’s not a record. Tyreek Hill's $30 million was 14.4 percent of the 2022 cap, though the deal's high non-guaranteed final year inflated the average.

In 1996, Jerry Rice signed a $5.8 million per year contract that was 14.2 percent of the cap. Randy Moss’s $9 million per year contract in 2001 was 13.5 percent of the cap.

Those contracts were outliers at the time. The biggest difference today is how many players hit those marks.

What’s next for the receiver market?

With Jefferson signed, CeeDee Lamb and Ja’Marr Chase will get top-of-the-market deals next. What happens to players in the tiers below them might be the most interesting part of the receiver market.

Tee Higgins and Brandon Aiyuk are currently in limbo with their teams. Higgins officially signed the franchise tag and will play on it for the 2024 season, though the two sides still have until mid-July for a potential extension. Meanwhile, the 49ers and Aiyuk have not reached an agreement as he enters the season on his fifth-year option.

These two teams have structured their rosters around plus skill position talent. Cincinnati’s stance, dating back to last offseason, is it would not trade Higgins. He was instrumental to the offense, and having two top receivers on the outside made Cincinnati's offense work.

The Bengals even reset the roster in preparation to pay the offensive talent. Cincinnati parted ways with several defensive players and hoped defensive coordinator Lou Anarumo could get the most out of a young defense. But then Joe Burrow got hurt, and the defense only ranked 25th in EPA per play.

San Francisco has invested even more in the offense, with Christian McCaffrey as the top-paid running back, George Kittle as a top-three tight end, and Deebo Samuel as the 11th-highest-paid wide receiver. On a market deal, Aiyuk would surpass all of them.

These are the types of players who could be impacted most by the market. These 1B options on teams with a 1A should make more than $30 million per year, but that’s a tough spot to put an offense in, especially when there are other pieces on the same side of the ball that need to be paid as well.

This will also matter for the tier of WR2 types. We’ve already seen players like this moved instead of getting extensions. Diontae Johnson was traded away from the Pittsburgh Steelers this past offseason after signing a two-year extension of around $18.4 million annually. Jerry Jeudy was also traded from the Broncos to the Browns before he signed a three-year extension at $17.5 million AAV.

The draft and the influx of talent at the position will likely make the biggest impact in this tier. The Broncos now have Marvin Mims and Troy Franklin to replace Jeudy, and the Steelers drafted Roman Wilson to help replace Johnson.

We also saw teams let free agents in this tier hit the market and then replace them in the draft. Gabe Davis and Darnell Mooney were really the only multi-year mid-level free agents, and their former teams replaced them with Keon Coleman and Rome Odunze, respectively. The Jaguars played both sides by signing Davis, not matching a contract for Calvin Ridley, and drafting Brian Thomas Jr.

The Jeffersons of the world are not the ones who will be replaced by draft picks. But the fascinating development from this will eventually be what happens with a player like Jordan Addison — a first-round pick drafted to replace Adam Thielen (an expensive WR2) and play next to Jefferson.

Addison just finished an impressive rookie season, so we’re at least two years away from that discussion, but he could be the type of player that serves as the tipping point of where this market will go long-term.

>> READ: Predicting Lamb and Chase's Next Contract

Can the quarterback market sustain this way?

The NFL reached a point where the mid-tier quarterback extension became nonexistent. A player was either the next in line to be the highest-paid player at the position, or the team was looking for another quarterback.

In the past few offseasons, that middle of the market slightly returned. The Daniel Jones contract was insane for the player and situation, but it settled at around 17.8 percent of the cap when signed at $40 million per year. Kirk Cousins' deal this offseason was 17.6 percent of the cap at a $45 million average.

Derek Carr has been on both sides of this. His extension with the Raiders in 2017 at $25 million per year made him the highest-paid quarterback by average value and made up 15 percent of the cap. His 2022 extension with Las Vegas made him the fifth-highest-paid quarterback for 19.4 percent of the cap. But after his release, his contract with the Saints averaged $37.5 million annually and 16.7 percent of the cap. By AAV, Carr is 15th among quarterbacks.

It appears we’re swinging back to top-of-market-or-nothing for upcoming quarterback deals. Jared Goff hit a $53 million average, making him the second-highest-paid quarterback, and Lawrence matched Joe Burrow’s $55 million per year.

While these deals are still technically below some of the contracts given out during the past few offseasons by the percentage of the cap at the time, we’re now at a place where quarterbacks will consistently hit an average of 20 percent of the cap going forward.

Tua Tagovailoa and Jordan Love are two young quarterbacks likely to hit that figure next — possibly as early as this offseason. Then there’s Dak Prescott, who could hit unrestricted free agency and command at least $60 million annually on the open market.

Prescott is his own thing, so let’s keep our focus on the young quarterbacks. The sustainability of paying this group at the top of the market might depend on how creative teams can reach the necessary raw figures without fully flooding the cap.

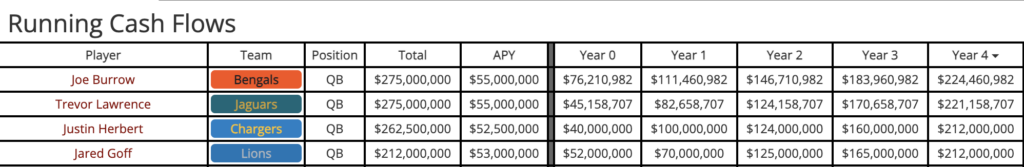

Let’s take a closer look at Lawrence’s deal. By the guarantees and cash flows, it’s slightly closer to the Justin Herbert contract than Burrow’s.

The cash flows and guarantees are healthy among the top through the deal's first five years. Where the Jaguars helped themselves is the “five-year extension” doesn’t kick in until 2026, so the new money can be paid in seven years of a contract.

That allows the Jaguars to give Lawrence a decent guarantee structure and heavily inflate non-guaranteed years at the end of the contract to inflate the average value. Lawrence is scheduled to have cap hits of $78.5 million and $74.8 million in the final two years of his deal.

By the end of 2028, which is only the third year of the extension, the Jaguars will either rework this deal, or it will be clear Lawrence is not the answer. Either way, those final two years will not be played on as currently laid out. Until that point, Lawrence never exceeds a $50 million cap hit.

The Jaguars structured the deal this way because they got it done early with two potential years left on Lawrence’s contract. That won’t be the case for Tagovailoa and Love, 2020 draft picks who are playing in the final years of their deals. Love and the Packers negotiated a new contract extension last offseason, but that was mostly just a hedge on the fully guaranteed fifth-year option for 2024.

Both quarterbacks will push for the Lawrence average, but it will be paid out in a shorter timeline. Compare Lawrence's escalation of cap hits to Goff’s, who only had one year remaining on his contract.

Goff will account for $27.2 million in 2024 and $32.6 million in 2025, which jumps to $69.6 million in 2026. That figure will be reworked by then, but the decision will come quicker, and the option will be to restructure and push money back into future years on the cap.

We’ll see the biggest impact of these contracts come this offseason because of the quality of quarterbacks due for new deals. The top of the 2020 class was already paid with Tagovailoa and Love to come. Lawrence is the sole survivor of the 2021 draft class. Next offseason, Brock Purdy becomes extension-eligible.

The timing of Lawrence's deal and how it ages could affect whether teams try to jump early on extending the 2023 draft class, most notably C.J. Stroud — with the outlook of Anthony Richardson and Bryce Young pending.

As a second-round pick, the Titans would not have the same luxury with Will Levis without the fifth-year option in place.

>> READ: Dallas' Impending Dak Disaster

Who’s Next?

Nearly every position has taken a jump with the cap over the past two seasons, but cornerback is the exception. Cornerback is the only position, aside from center, where the top contract by AAV was not signed within the past two years — and that’s even cheating a bit for center because Jason Kelce did qualify, but he retired.

The high mark at cornerback is still Jaire Alexander’s 2021 extension, which came out to $21 million per year. This offseason's top cornerback contracts fell short of that market, with neither L’Jaruius Sneed ($19.1 million) nor Jaylon Johnson ($19 million) crossing the $20 million per year threshold.

Even Alexander’s contract wasn’t a huge movement in the cornerback market. Marshon Lattimore signed a five-year, $97 million extension in 2021, with the AAV hitting 10.6 percent of the cap.

This was a down year for the cap, but the current value equivalent would be an average of $27.2 million. Alexander’s deal a year later had an AAV of 10.1 percent of the cap, the same as Jalen Ramsey’s extension from the year prior.

That will likely change soon with players like Sauce Gardner and Patrick Surtain up for extensions. Surtain is already extension-eligible after playing three seasons, and Gardner will hit that mark next offseason.

Both players deserve to hit the top of the positional market; the question will be by how much. Alexander’s deal would be the equivalent of $25.8 million in 2024, a figure more than reasonable for Surtain and Gardner to ask for. However, hitting a $26 million average would be nearly a 24 percent increase on the raw average, presenting a massive jump.

The difference could be split somewhere between the two figures, but regardless of the ending price, the market for corners will likely reset soon.